by Saunder Schroeder • May 21, 2020

You’re Approaching Lifetime Value the Wrong Way. Here’s Why.

Lifetime value is a big deal to ecommerce businesses…whether they realize it or not.

For some businesses, lifetime value is how they make their marketing campaigns work. One of our clients spends a $1.87 on marketing for every dollar they make in sales—on month one. However, most customers stick around for years, so in reality, their overall return on investment is about 31x.

Many businesses, however, are completely focused on being profitable on the first sale. They almost completely ignore their customer lifetime value and treat each purchase as a one-time event. If they happen to get more sales down the road, that’s nice, but they don’t plan on it.

That might be how things work for some businesses, but for most, their reality lies somewhere between these two extremes. They can’t assume that they’ll get tons of purchases from every customer, but a good chunk of their sales do come from repeat business.

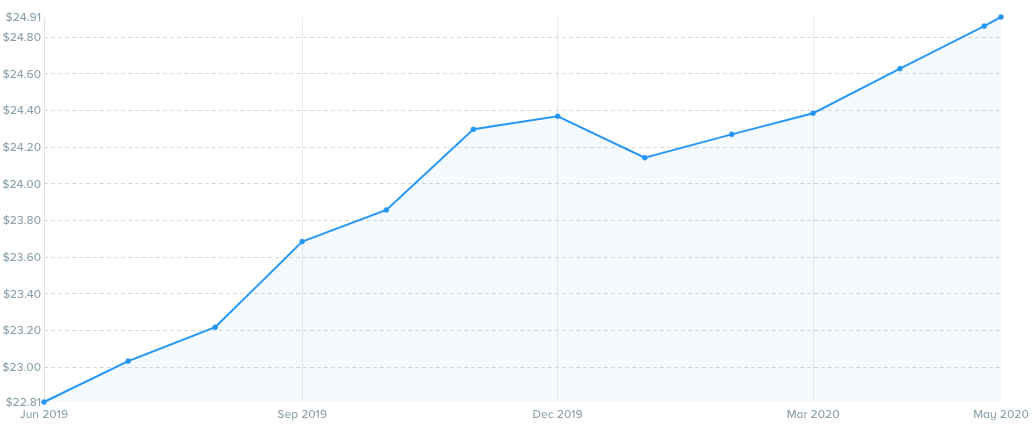

When working with these types of clients, we typically see three different lifetime value (LTV) trends, as shown below:

These reports are pulled from three of our clients. Obviously, they each have their own average order value and products, but assuming all things are equal, which lifetime value trend would you pick?

If you’re like most people, graph #2 probably caught your eye immediately. We all love an upward trend, after all.

However, here at Disruptive, we’ve found that graph #3 tends to be our favorite. The overall trend is still upwards, but it’s interrupted by regular peaks and valleys.

To be honest, though, there’s nothing wrong with any of these graphs. You just have to understand what they’re telling you about your sales and what they mean for your business.

And that’s what this article is about.

You see, customer lifetime value is one of the most important parts of your ecommerce business and knowing how to use it can be the difference between marketing success and failure.

In this article, we’re going to redefine how you think about lifetime value. We’re going to talk about each of these types of trends, what they mean and how to use them in your marketing strategy. Let’s get started.

Why a Downward LTV Trend May Be Okay

In general, downward trends mean bad things for your business.

If revenue trends downwards, you may be headed towards bankruptcy. If your clickthrough rate trends downwards, something may be wrong with your advertising. If repeat sales trend downward, people may be dissatisfied with your products.

However, if your lifetime value is trending downward, that may not be an altogether bad thing.

Of course, we’d all like to see lifetime value go up indefinitely, but in some cases, a drop in LTV actually means you’re doing things right with your marketing.

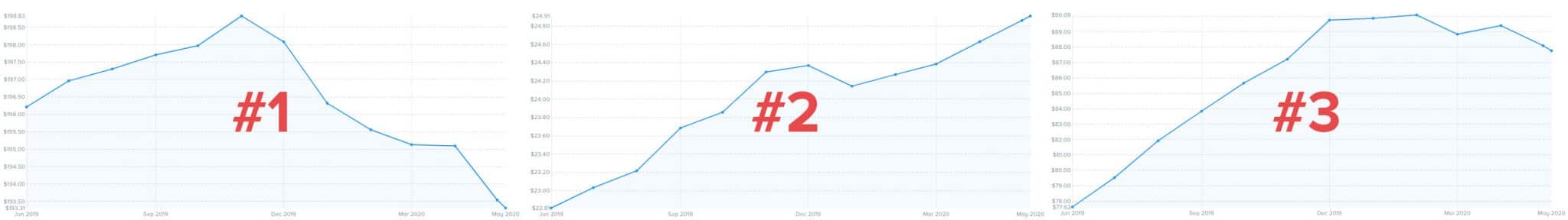

Take the graph below, for example:

This particular trend line comes from a client of ours. If you pay attention to the timeline, you’ll notice that their LTV peaked right around the holiday shopping season.

There’s a reason for that.

During the holidays, this client took advantage of the increased demand for their products and focused on nurturing their existing customers. As a result, their average lifetime value went up.

However, after the holidays, their average LTV dropped quite a bit. Why? Because they were acquiring new customers. The newer the customer, the less opportunity they’ve had to make additional purchases and the lower their lifetime value is.

[clickToTweet tweet=”If you’re marketing aggressively, don’t sweat a low LTV. It usually means you’re doing something RIGHT!” quote=”If you’re marketing aggressively, don’t sweat a low LTV. It usually means you’re doing something RIGHT!”]

The bottom line of the graph is still $193.31, so this client is doing just fine. In fact, they’re doing better than fine, because they’re filling their pipeline with satisfied customers—additional customers they can market to during the coming holiday season.

You see, lifetime value isn’t directly related to revenue. It’s a reflection of order value and customer age. The more new customers you have, the lower your LTV will be.

So, if you are aggressively growing your customer base and your lifetime value drops, don’t panic. It’ll bounce back up with time as those new customers become recurring customers.

Increasing Lifetime Value the Right Way

On the flip side of things, an upward trending lifetime value could actually mean that your business is struggling. If you’re not bringing in new customers and your existing customers are the only ones making purchases, lifetime value could go up…while your business goes under.

This isn’t usually the case, but it certainly can happen.

Where we do see more of this phenomenon, though, is with businesses that pull back on advertising. They might not be killing their business, but when they put marketing on the backburner, it can sometimes look like things are improving—at least, from a lifetime value perspective.

Now, don’t get me wrong. An upward trending lifetime value isn’t a bad thing. You just have to understand how it fits into the bigger marketing picture.

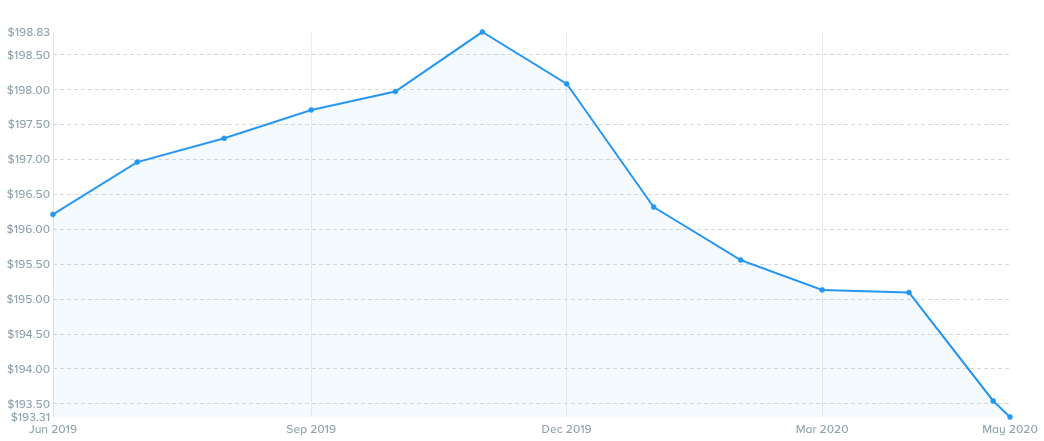

For example, if you’re actively nurturing your existing customers, increased lifetime value means that your nurturing efforts are working. That’s exactly what’s going on in the graph below.

When LTV is growing like this, it means your nurture program (email, SMS, chat, social media, etc) is doing what it needs to do—getting existing customers to come back and purchase.

Excuse the shameless plug and my early 2000’s high school lingo, but as you can see above, we have a pretty ballin’ nurture team.

As we all know, it’s a lot cheaper to nurture existing customers than it is to acquire new customers. We typically recommend doing both. If your business has enough product frequency and loyal customers, you may even want to put the majority of your marketing budget into nurturing.

The Sweet Spot

The only effective way to increase lifetime value while simultaneously growing your business is to aggressively acquire new customers…and then nurture them like crazy.

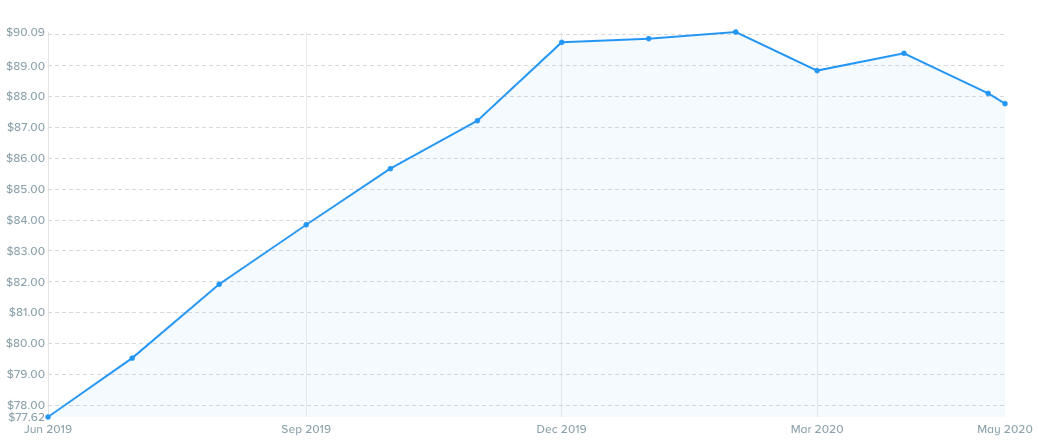

When you do, it typically results in a “peaks and valleys”-type LTV graph like the one below:

As you can see here, this client’s customer LTV steadily grew throughout last year while they were capitalizing on their customer base and then leveled off after the holidays.

At Disruptive, we like to focus on customer acquisition during the first 6-9 months of the year. There are a few reasons why, but the biggest is that costs to acquire new customers spike on ad platforms starting in late October through late December. Nurture costs don’t increase during this time frame, though there is additional friction.

Of course, we don’t stop acquiring new customers for our clients during the holidays—we just prefer to focus more on acquisition during the beginning of the year and on nurturing customers during the holiday season.

This acquisition-nurture cycle is why we like to see “peaks and valleys” in customer lifetime valley. When your marketing is working well, you’re constantly acquiring new customers and then trying to turn those customers into loyal, long-term fans of your business.

As a result, over the months and years, your lifetime value falls some while you’re focusing on acquisition and then rises as you emphasize nurturing. But, since you’re always growing your customer base, the overall trend is upwards—even if you have temporary dips.

Making Sense of Your LTV

As you evaluate your own LTV trends, keep in mind that the right trend for your business will be heavily dependent on what you’re selling, how often you expect repeat business, what sort of growth phase your business is in and even the time of year.

While we’d all like to have an endlessly upward trending graph, things are much more complicated in real life. For some businesses, a downward trend can be a good thing (to a point, at least) and an upward trend could be a bad thing. You just have to look at it all with the right perspective.

With LTV, the most important thing to remember is that good ecommerce marketing builds on itself. You acquire, acquire, acquire and then nurture, nurture, nurture.

[clickToTweet tweet=”Good ecommerce marketing builds on itself. You acquire, acquire, acquire and then nurture, nurture, nurture.” quote=”Good ecommerce marketing builds on itself. You acquire, acquire, acquire and then nurture, nurture, nurture.”]

If you do it right, you’ll end up with an ever-growing base of long-term customers. The profitability of your campaigns will go up—right along with the sustainability of your business.

Conclusion

So, should you freak out if your lifetime value is falling? Maybe, but probably not. It all depends on what you’re trying to achieve with your marketing at that given moment in time.

The trick is to balance acquisition and nurturing in a sustainable way. As long as you’re paying attention to both, your LTV will almost always bounce back in the long run. You might have peaks and valleys, but you’ll be building a customer base that will support your business for years.

By the way, if you’d like help with customer acquisition, nurturing or getting your LTV back on track, let us know here or in the comments. This is a passion of ours, so we’d love to help.

How do you approach customer lifetime value? Did we challenge any of your assumptions? Have any advice to share on how to improve customer lifetime value? Leave your thoughts in the comments below.